Silver Solutions Beyond Product Development: Innovating Insurance for South Korea’s Senior Market

Kyeonghwa Kim, Chief Pricing Actuary, RGA

1. Introduction

Over the past few decades, South Korea has witnessed remarkable economic growth, emerging as the eighth-largest global life insurance market in terms of gross written premiums.

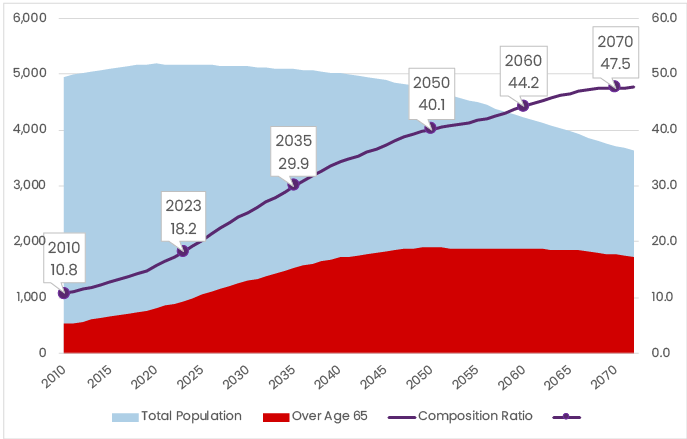

By 2025, Korea is expected to enter a super-aged society, meaning the elderly population aged 65 and above exceeds 20 percent of the total population. This rate of aging is unprecedented, not just in Asia but across the world [1].

This new demographic paradigm shift has created significant challenges for many financial institutions, but also presents new opportunities for insurance innovation, particularly in senior-related offerings. Insurers that proactively prepare for and respond to these demographic shifts will be well positioned to capitalize on the opportunities for growth.

In the face of these dramatic demographic changes, the role of insurance companies is becoming increasingly important. The Korean insurance industry has responded to the pressures of an aging society by developing various new products targeting seniors, such as simplified underwriting (UW) products and dementia/long-term care (LTC) insurance. Among these, simplified issue (SI) insurance is considered one of the most successful products targeting seniors in Korea.

SI products helped the Korean insurance industry overcome its low-growth crisis in the mid-2010s. However, since 2020, intense competition in the life & health market has led to cheaper and more aggressive new SI products entering the market. This has had unintended consequences, including existing SI policyholders switching to these new offerings. Furthermore, overheated competition has resulted in shorter product life cycles and reduced profitability.

This paper will introduce some senior products with simplified UW (guaranteed Issue/simplified issue) that have been introduced in the Korean market, explain how the senior market has evolved over the past decade, and conclude with a discussion on how insurance companies can tap into the potential of the expanding senior market by exploring a comprehensive and sustainable senior business model that offers holistic services to senior customers beyond traditional product development.

Road to an Aging Population

In the year 2000, only 11 percent of the South Korean population was aged 65 and older. However, by 2023, this proportion had risen to 18 percent. Projections from Statistics Korea suggest that by 2060, an astonishing 44 percent of South Korea’s population will fall into this age group. This demographic shift underscores the need for insurers to adapt their offerings to cater to the unique needs of an aging society.

[Figure 1 – Population of aged 65 and above (% of total population)]

Source: Statistics Korea (https://www.kostat.go.kr/ansk/), 2024

South Korea’s population is aging more quickly than any other developed country. It took only 19 years for the country to transition to an aging society and a mere 8 years to approach the threshold of a super-aged society (where 20 percent or more of the population is aged 65 or older). In comparison, the United States, Japan, and Germany took 72, 25, and 40 years, respectively, to reach similar demographic milestones (see Table 1). This unparalleled rate of aging presents South Korea with significantly less time to adequately prepare for the challenges posed by an aging population.

[Table 1 - The number of years required toward “aged society” and “super-aged society”]

| REACHING YEARS | YEARS REQUIRED | ||||

| COUNTRY | AGING SOCIETY (7%) | AGED SOCIETY (14%) | SUPER-AGED SOCIETY (20%) | 7% - 14% | 14%-20% |

CANADA FRANCE GERMANY ITALY JAPAN USA KOREA WORLD

| 1945 1864 1932 1927 1970 1942 1999 2002 | 2010 1978 1972 1988 1995 2014 2018 2039 | 2024 2018 2008 2007 2006 2031 2026 - | 65 114 40 61 25 72 19 37 | 14 40 36 19 11 17 8 - |

Source: Demographic transition and the role of financial sector(저출산고령화와 금융의역할),) by Sunghoon Yoon, 2011

Improved Life Expectancy

One of the main drivers of the growth of the older population is the increase in life expectancy. This can be attributed to several factors, including medical advances, healthier lifestyles, and a decrease in non-communicable diseases. As of 2021, life expectancy at age 65 in South Korea has surpassed the Organization for Economic Cooperation and Development (OECD) average, with women living 2.5 years longer and men living 1.5 years longer than the OECD average [2].

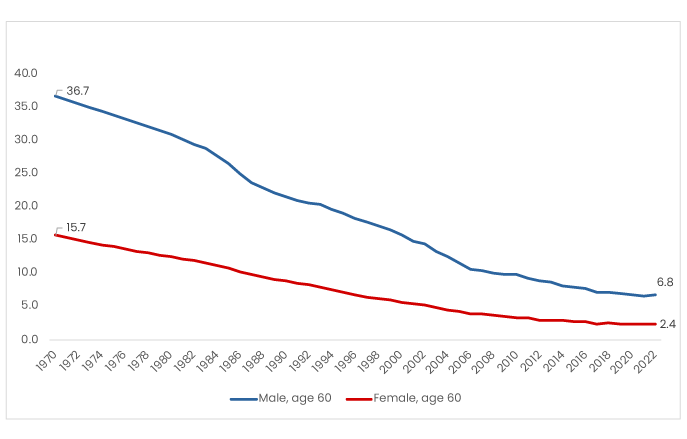

As shown in Figure 2, the general population mortality rate has improved by an average of 3.5 percent annually for both men and women over the past 50 years. This dramatic improvement is unprecedented and has not been seen in any other country in the world.

[Figure 2 – South Korea general population mortality rate (per 1,000) from 1970 to 2022]

Source: Statistics Korea (https://www.kostat.go.kr/ansk/), 2024

Rapidly Declining Fertility Rate

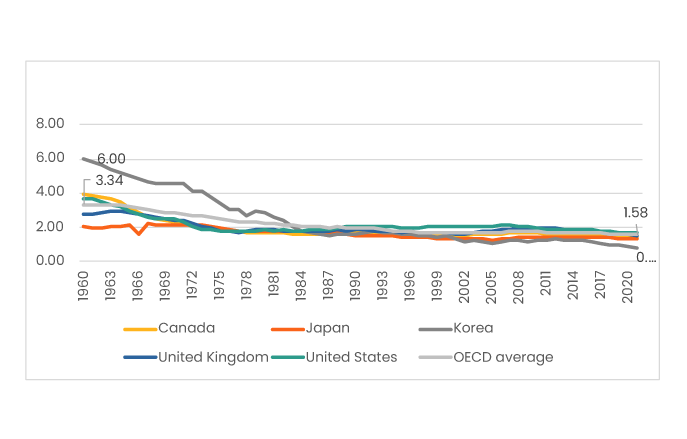

Another factor contributing to the aging population is a declining fertility rate. South Korea's fertility rate, among the lowest in the world, plummeted from 4.5 in 1970 to 0.78 in 2023, well below the replacement rate of 2.1 needed to maintain a stable population.

The decline in birth rates is not unique to South Korea; many developed countries also face this issue. However, since the Korean War, rapid industrialization in South Korea has led to a decrease in birth rates at an unparalleled pace.

This dramatic decline has left the country facing the dual challenges of an aging population and a shrinking labor force. Fewer young people contributing to the labor force could slow economic growth. In addition, as the elderly make up a larger and larger proportion of the total population, the government will face greater challenges in providing social services.

[Figure 3 – Total fertility rate (%) from 1960 to 2020]

Source: Organization for Economic Cooperation and Development, 2023

Shrinking Average Size of Household

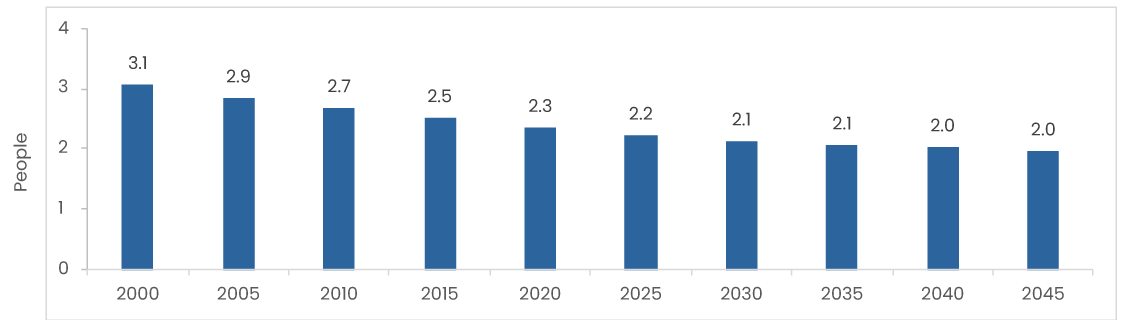

Due to the declining birth rate, the average size of households is gradually shrinking. That average is expected to decrease from 3.1 persons per household in the early 2000s to 2.0 per household by 2045. The number of single-person and couple-only households has increased significantly and is expected to continue to grow.

The factors fueling this decrease include rising higher education levels among women, a variable linked to fertility and family composition. Other factors, such as the increase in the unmarried population and high divorce rates, have also affected the size and structure of families. All of these trends have led to the breakdown of the traditional family structure, resulting in reduced support for the elderly.

Consequently, the declining birth rate and changes in family structure have reduced family support for the elderly, significantly increasing the governmental and societal burden of covering the costs of elderly care.

[Figure 4 - Average size of households]

Source: Korean Statistical Information Service (https://kosis.kr/statHtml/statHtml.do?orgId=101&tblId=DT_1BZ0503&conn_path=I3 ), 2024

The Evolution of Senior Insurance Products (Rise and Fall of Simplified Issue Products)

Background

Traditionally, the insurance market in South Korea has predominantly focused on developing products for healthy individuals aged between 20 and 50. However, due to a declining healthy population and their waning interest in buying insurance, the South Korean insurance industry has entered a slow growth phase since 2010.

In response to this challenge, many Korean insurance companies have expanded their target customer base to reach out to the growing number of impaired and senior lives by introducing simplified underwriting products. It goes without saying that the number of impaired lives is increasing as the population ages. Historically, however, only a small proportion of these individuals was able to obtain insurance coverage, resulting in a significant coverage gap in this segment of the population.

First Guarantee Issue Product in 2007 (Kumho Life):

In 2007, prior to the introduction of simplified issue products, Kumho Life (now known as KDB Life) launched Korea’s first guaranteed issue (GI) product for death benefits. This product aimed to create a balanced risk pool by integrating standard lives seeking a simplified process with substandard lives at reasonable pricing.

Unfortunately, the company experienced unexpectedly high loss ratios from this product because face-to-face agents sold it primarily to individuals with pre-existing conditions or very serious health conditions. This adverse experience led insurers to stop developing simplified issue/guaranteed issue (SI/GI) products for several years.

Silver Cancer Product in 2011 (Lina)

In 2011, Lina Korea introduced a pioneering cancer insurance product called Silver Cancer. This product featured partially simplified underwriting, utilizing the existing standard underwriting application form while relaxing medical disclosures related to hypertension and diabetes.

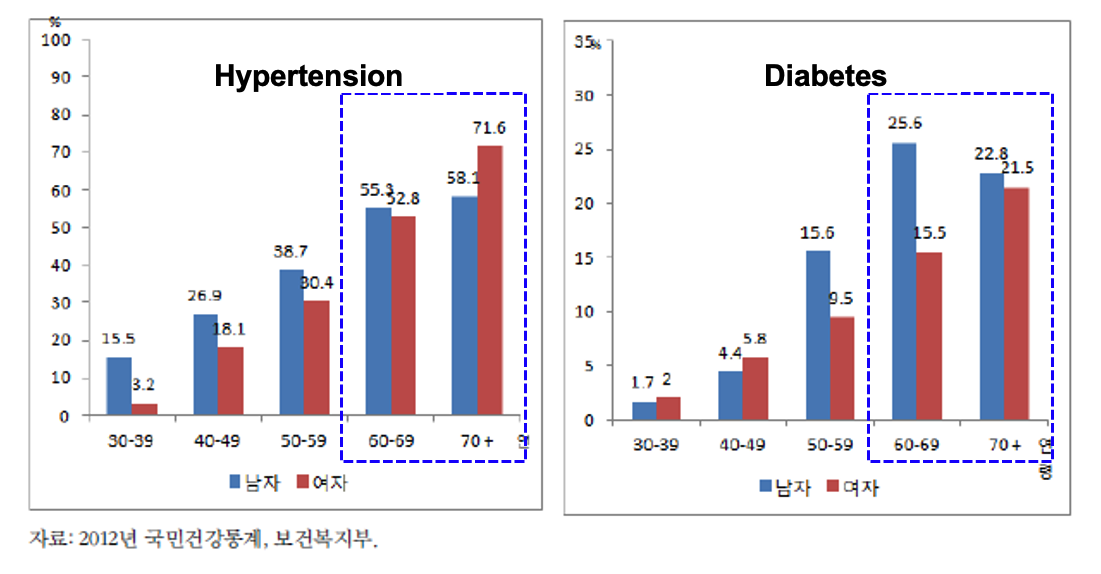

According to the National Health and Nutrition Examination Survey, the most prevalent chronic diseases among Koreans over the age of 60 are hypertension and diabetes (see Figure 5 for the prevalence rate percentage for hypertension and diabetes by age group). By eliminating underwriting questions related to these conditions, insurers were able to streamline the approval process for a large number of senior applicants. In addition, since hypertension and diabetes have a relatively minor impact on cancer risk, this relaxation of underwriting requirements did not have a significant impact on pricing, thereby mitigating risks for insurers and reducing premiums for customers.

[Figure 5 - Prevalence rate (%) for Hypertension and Diabetes by age group]

Source: Ministry of Health and Welfare, 2012 national health data

Silver Cancer achieved significant success in terms of both sales and profitability, inspiring other market participants to develop similar simplified underwriting products. Prior to the introduction of Silver Cancer, most cancer insurance products in Korea were only available to customers under the age of 60, resulting in a substantial backlog of over-60 customers seeking cancer coverage. However, after witnessing the strong sales of Silver Cancer, the entire market quickly followed suit by launching comparable cancer products within a year. Consequently, Silver Cancer is recognized as the first senior product to successfully penetrate the senior market in Korea.

Simplified Issue medical/CI products in Mid-2010s (AIA and Hyundai Fire & Marine

In 2012, AIA Korea, one of the major Korean multinational life insurers, successfully launched the industry’s first simplified issue (SI) medical product. This innovative offering reduced the number of underwriting questions to just three. It also shortened the required medical history disclosure for hospitalizations and surgeries from five years to two years. As a result, enrolling in this SI product became significantly easier compared to fully underwritten alternatives.

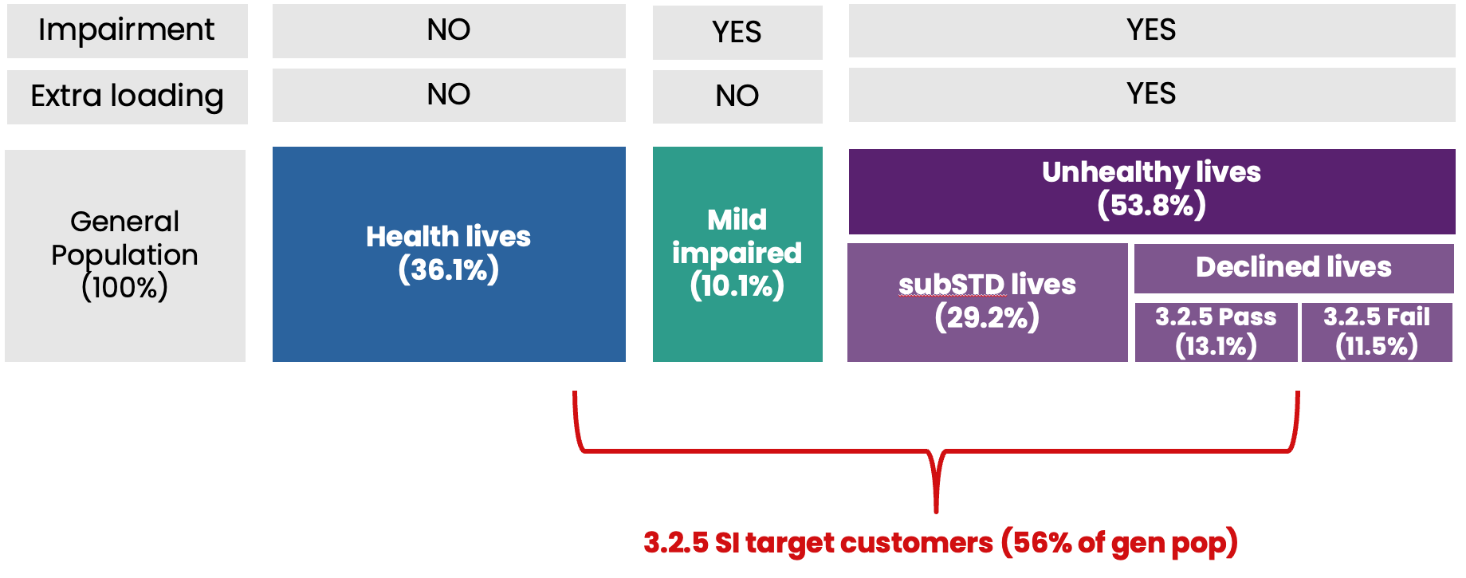

Notably, it was also the first insurance product to extend coverage to people with mild chronic conditions, including those in their 40s and 50s. According to research by RGA, approximately 56 percent of the population aged 40 and above is eligible to purchase SI products (see figure 6). This means that more than half of the Korean population over the age of 40 could potentially benefit from these streamlined insurance offerings. Among all existing senior insurance products, SI products have the broadest and most extensive target consumer base, which translates to the largest sales potential.

[Figure 6 – Estimated SI market size among Koreans 40+ years old]

Source: Centers for Disease Control and Prevention (CDC), 2012 Korea National Health and Nutrition Survey raw data

With just three straightforward questions and a streamlined underwriting process, the product caught the market’s attention because it takes only a few minutes to determine whether applicants can meet underwriting requirements without submitting medical evidence. Previously, one of the biggest frustrations for sales agents and applicants was not knowing if they would meet underwriting requirements after disclosing their medical histories at the point of application.

However, despite positive responses from sales agents and customers, few insurers attempted to develop SI products due to concerns about risks, lack of experience with the product, and difficulties in developing risk rates. The major impediment to product growth was insufficient data.

In October 2015, the Financial Supervisory Service (FSS) announced the “Roadmap for Strengthening the Competitiveness of the Insurance Industry” to encourage the development of senior insurance products. The key part of the plan was to abolish or ease regulations on product development in line with the implementation of price liberalization.

The deregulation of insurance product and price liberalization policies greatly helped insurance companies enter the senior market. Around the same time, Korea Insurance Development Institute (KIDI), the Korean regulator that reviews and approves insurer’s risk rates, began calculating SI loadings using industry claim data and sharing that information with small or middle-sized companies that lacked data. This initiative made it possible for almost all companies to develop SI products.

In 2015, Hyundai Fire & Marine, a major nonlife insurance company, launched a comprehensive SI product that covered not only 3CI (cancer, stroke, acute myocardial infarction) diagnosis but also offered medical benefits. This product was a huge hit in the market. Moreover, the initial claims experience of the first company to sell this SI product was quite positive, without any sign of anti-selection. Therefore, many insurers became comfortable with the risk.

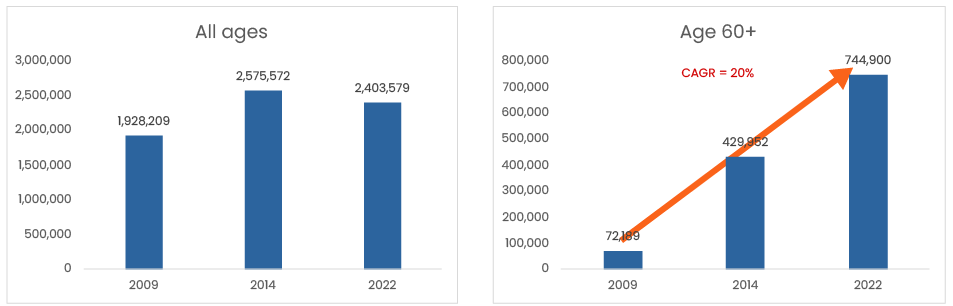

In 2016, the market exploded as all the major life and nonlife companies began selling SI products, and sales skyrocketed. The number of new insurance policies for those aged 60 and over has increased sharply since the SI product introductions, while the total number of new insurance policies has remained stagnant over the past decade (see Figure 7).

[Figure 7 – The number of new policies for protection products]

Source: Korea Insurance Development Institute (KIDI) yearbook

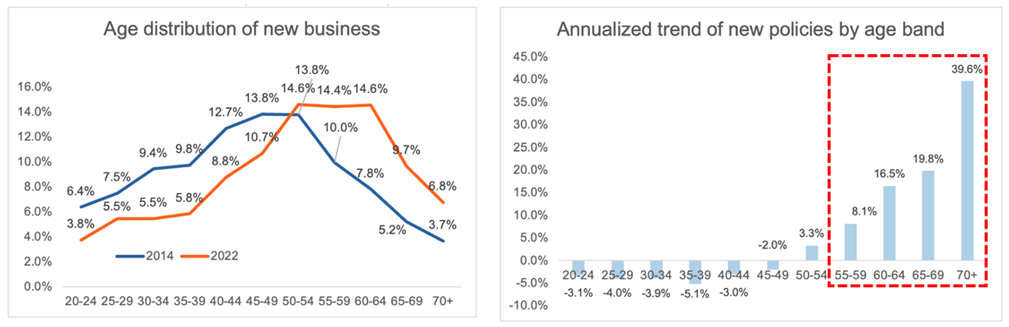

Since the SI market began to boom in 2016, these products have become mainstream for impaired and senior lives in Korea. As shown in Figure 8, the annual growth rate of new business for seniors aged 60+ is about 20 percent, while growth rates for other age groups is declining. The age distribution of new policies reveals that the proportion of seniors has been increasing since 2014, and more than 30 percent of all new policies issued in 2022 were for those aged 60 and over. Therefore, SI products have greatly helped the insurance market overcome the challenges of stagnant business growth due to the aging population.

[Figure 8 – The number of new policies for protection products]

Source Korea Insurance Development Institute (KIDI) yearbook

Source Korea Insurance Development Institute (KIDI) yearbook

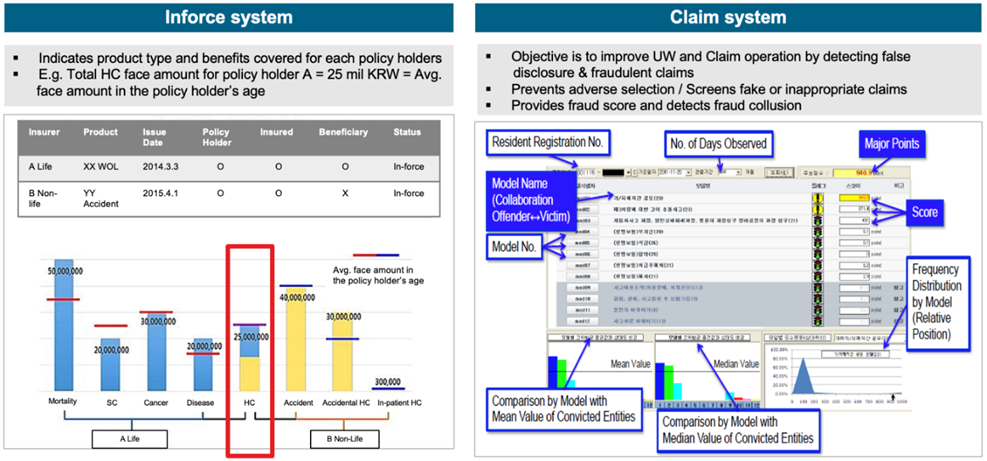

Centralized Industry Database in Korea

One of the things that make Korea’s SI market so unique and successful is the industry-centralized system called Insurance Credit Information Service (ICIS). The database was established in 2016 to centrally manage credit, insurance, and tech-finance information across the insurance industry.

South Korea is the only country in the world with an industry-wide centralized database where all policy and claim information is stored and shared by all insurers. No other country has such an integrated industry-wide database, which makes it more challenging for simplified UW products to succeed compared to Korea.

The entire insurance industry shares claims and in-force data through ICIS, enabling insurers to assess the risk profiles of applicants more accurately during underwriting. Although the SI questionnaire consists of only three questions, underwriting can still be effective by utilizing this centralized system. It helps insurers detect false disclosures more easily by using previous insurance claims and existing policies with other insurers.

In addition to the ICIS database, the meticulously designed product features, such as waiting periods and benefit reduction periods, along with adequately calculated SI loadings, have also contributed to the stable and positive loss ratios of early SI products.

[Figure 9 - Illustration of ICIS system]

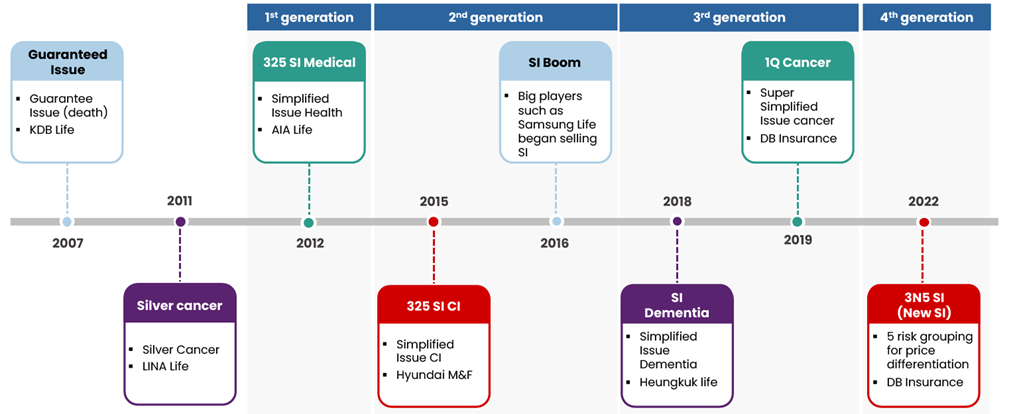

New Generations of SI products in Early 2020s

Since the huge success of SI products, both life insurance and nonlife insurance companies have strived to differentiate their offerings competitively. The first-generation SI products were quite simple, covering only a few health benefits, such as hospital cash and surgery cash. However, the new generation of SI products is DIY (do-it-yourself): applicants design their own product by selecting from among 50 to 100 optional riders based on their needs and preferences.

Particularly within the nonlife insurance sector, which has dominated the accident and health insurance market since 2017, there has been active development and differentiation of SI products. Coverage has expanded beyond simple hospitalization, surgery, and 3CI (cancer, acute myocardial infarction, and stroke) diagnosis to cover mild illnesses.

Given the favorable loss ratios of early SI products and intensified competition in the SI space, some nonlife companies became more aggressive by extending the maximum entry age to age 90 and providing a rate guarantee of up to the insured’s lifetime (see Table 2 for the comparison of new generations and the first-generation SI product).

[Figure 10 – History of senior products in Korea and SI generations]

[Table 2 - Comparison of new SI generation to the first generation]

| First generation (2012) | New generation (2022~) | |

| Product type |

|

|

| Issue age | Age 40-75 | Age 15-90 |

| Rate guarantee /policy period | 10 years renewable | Various renewable periods (10, 15, 20 years) or lifetime guarantee |

| UW questions | 3 questions | Many variations in term of the length of time without hospitalization or surgery and types of pre-existing conditions removed in SI questionnaire |

| Target customers | New customers with pre-existing conditions who have had difficulty obtaining insurance due to strict underwriting | New customers + upselling new riders to existing SI policyowners |

The initial differentiation strategy for this product started with expanding the entry age, coverage period, and maximum sum assured, followed by coverage differentiation, such as covering various milder diseases and increasing the number of riders attachable to the base policy. Then, in 2018, new SI products such as simplified issue dementia insurance and senior dental insurance were introduced to the market for the first time. As a result, a wide range of senior products have been available in the market, allowing each senior to choose the solution that best meets his or her diverse needs.

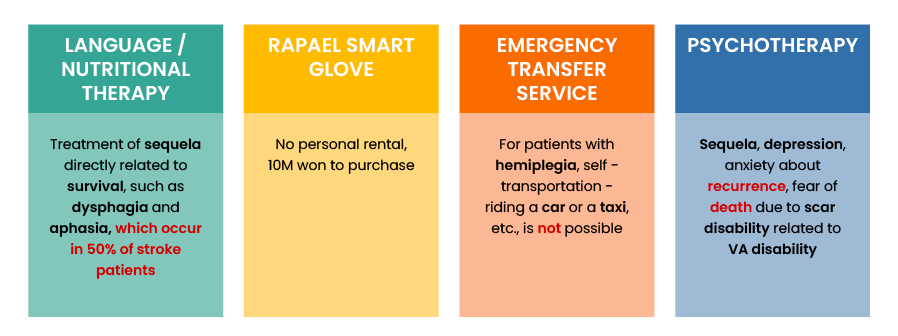

Over time, as competition became more intense, some insurers began to modify existing underwriting questions, resulting in many variations of SI questions from different insurers. Notably, in 2019, the first cancer insurance product to ask only one question (called 1Q cancer) was introduced to the market, but many companies didn’t join the trend due to risk concerns. Some nonlife insurers have also launched products offering a variety of in-kind services such as speech and nutrition therapy and psychotherapy, in addition to cash payouts in the event of a critical illness, such as stroke.

[Figure 11 – Examples of in-kind services in SI products]

Source: 보험상품 변천과 개발 방향” (The Evolution and Development Direction of Insurance Products) from the Korea Insurance Research Institute (KIRI) by Sukyoung Kim, Seyoung Kim and Sunjoo Lee, 2018

In the early 2020s, the industry faced limitations in differentiating through diversifying questionnaires and expanding coverage. In addition, consumers have become more price-sensitive as the Korean economy has slowed following the shock of COVID-19.

To address these factors, Dongbu Fire & Marine, a major nonlife insurance company, launched a new SI product called 3N5 SI, which includes five plans: 315, 325, 335, 345, and 355 SI. This product categorizes an applicant’s impaired health status in detail and offers customized rates corresponding to each risk. It features a system that divides customers with a history of hospitalization or surgery within the last five years into five risk groups, each of which has a risk level ranging from one to five years depending on how long it has been since the treatment.

Each risk group is then charged a different risk premium, with impaired individuals with no recent history of hospitalization or surgery paying a lower premium. For example, 355 SI (no hospitalization/surgery in the past five years) is around 30 percent to 35 percent less expensive than the existing 325 SI (no hospitalization/surgery in the past two years).

The product has been very well received in the market, leading many other insurers to follow suit, and making this product a new norm in Korea. However, contrary to the original intention, this offering has triggered some churn in the market with existing 325 SI policyholders switching to the new, more affordable SI product.

Next Steps and Future Direction

As mentioned earlier, around the mid-2010s, the Korean insurance industry reached a saturation point and faced a severe growth slowdown. Demographic changes, such as an aging population and a declining birth rate, also severely affected the industry. However, insurers have turned this crisis into an opportunity by significantly lowering the barriers for elderly individuals to purchase insurance through simplified issue products, successfully tapping into the senior market.

Despite this success, intensified market competition has led to a focus on aggressive product design and pricing rather than stressing customer value creation. This has resulted in shorter product life cycles and negative effects on profitability, steering the market into an undesirable and unhealthy direction.

To reverse this situation, the industry needs to adopt a multifaceted approach and move beyond simply selling life insurance products to offer customized products that serve the diverse needs of the elderly over the long term. Examples of this include providing coverage for the costs of senior care services such as nursing homes and senior living communities; managing retirement assets; and offering coverage for in-kind health promotion services, for example, AI-based health monitoring systems and telemedicine.

As the elderly population grows, the number of people with dementia and mild cognitive impairment is on the rise, intensifying the interest in early detection and prevention. In response, insurance products that focus on early prevention, such as providing in-kind services while covering mild dementia or cognitive impairment, have recently emerged to increase customer satisfaction and provide more comprehensive coverage. Table 3 offers examples of those products.

[Table 3 – Recent innovative ancillary services in senior products]

|

|

|

|

|

Smart Guidance/Wellness Program

|

|

|

|

|

| Provide Dementia Prevention Program

|

|

|

|

The recent regulatory changes by financial authorities aim to promote the integration of financial and non-financial sectors and enhance synergy. Regulations have been relaxed, allowing insurance companies to provide healthcare-related platform services. This creates a favorable environment for insurance companies to enter the digital healthcare service and senior care service industry.

Recently, some insurers have been actively entering the senior care service industry. Companies like KB Insurance have already established subsidiaries to provide premium life care services, including urban senior care facilities and day care centers. Other major insurers, such as Shinhan Life and NongHyup Life, are also exploring opportunities in this sector. These developments align with government efforts to lower barriers for insurers to enter the senior care service business and provide a wider range of services to senior customers.

However, despite these efforts, senior-related business is currently being conducted for individual needs, such as ancillary services to existing products, senior care service, silver towns, and trusts. There is still no comprehensive business approach to catering to the diverse needs of senior customers as a separate segmented market.

Just as people first think of Google when searching for information on the internet, there is currently a need for a senior-specialized business that provides a one-stop solution to meet various consumer needs after retirement, such as health management, prevention, insurance, and caregiving. However, such a business does not yet exist in Korea.

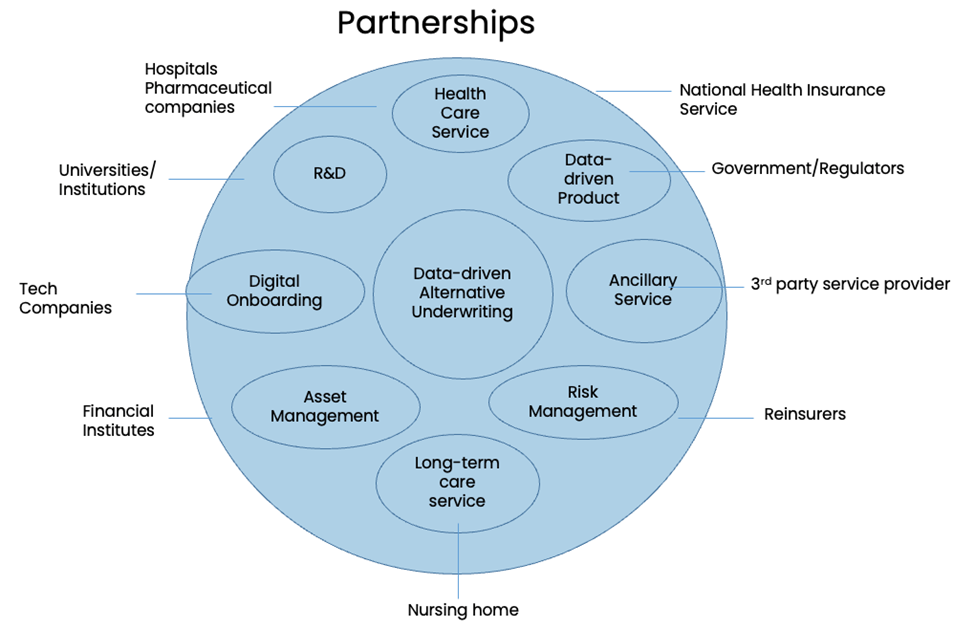

To overcome the challenges of an aging society and low business growth, insurers need to expand into digital healthcare and long-term care services, creating synergy with their existing value chains. They should prioritize excellent customer experiences, integrate medical and insurance services, and enhance sales efficiency through cross-selling. Partnerships with healthcare providers, financial institutions, and tech companies can improve execution and digital capabilities.

Ultimately, to differentiate customer value and secure long-term growth, insurers should aim to create a comprehensive lifestyle health management platform. This platform should seamlessly integrate preventive healthcare services, insurance, and post-care (long-term care) services into a one-stop solution, extending beyond their traditional roles of risk underwriting and coverage (see Figure 12).

Another strategy for insurers is to consider alternative underwriting for senior products, such as dementia insurance. Traditional underwriting relies heavily on medical records and standardized health questionnaires. However, insurers could use data on lifestyle factors—such as diet, exercise, cognitive engagement, and social activities—to assess dementia risk. The World Health Organization (WHO)[3] reports that people can reduce their risk of cognitive decline and dementia by being physically active, not smoking, avoiding harmful use of alcohol, controlling their weight, eating a healthy diet, and maintaining healthy blood pressure and blood sugar levels.

Additional risk factors include depression, social isolation, low educational attainment, and cognitive inactivity. Many of these risk factors are lifestyle and behavior related. Therefore, using the lifestyle and behavioral data such as diet, physical activity, cognitive engagement, social interaction, sleep, and stress to assess an individual’s risk of developing dementia can help insurers to improve access, affordability, and accuracy in underwriting decisions. This data can be gathered from sources like wearable devices, health apps, self-reported surveys, and electronic health records. By utilizing advanced analytics and dynamic monitoring, insurers can personalize coverage and incentivize healthy behaviors that reduce dementia risk.

Advocating for supportive regulatory frameworks is also crucial to facilitate the development and adoption of new insurance products and services. To promote the healthy development of the senior market, Korean financial authorities are actively exploring various strategies.

For example, the Korea Insurance Development Institute (KIDI) has recently proposed to revitalize the Korean individual annuity market by introducing impaired annuity products. This initiative aims to strengthen retirement asset security for seniors as the annuity market is shrinking every year. Impaired annuity differentiates annuity payout based on the health status of the insured, providing higher annuity amounts to those in poor health.

Developing customized application forms for the product and pricing appropriate rates based on credible data are critical steps. Currently, KIDI is leveraging mortality data from the insurance industry and the National Health Insurance Service (NHIS)’s long-term care database to develop impaired annuity rates, with the expectation of boosting the senior annuity market. Additionally, Financial Supervisory Service (FSS) is also taking steps to standardize long-term care (LTC) reimbursement products to prevent excessive market competition and ensure more sustainable market development.

By collaborating with various industries and regulators to approach the senior market from multiple angles, the insurance industry can achieve sustainable long-term growth. Providing not just a variety of products and ancillary services but also a comprehensive one-stop solution allows insurers to cater to the diverse needs of the senior market. Over time, this approach enables them to accumulate experience that can be leveraged to develop new products, creating a virtuous cycle.

[Figure 12 – Silver Ecosystem: one-stop lifestyle management platform]

______________________________________________________________________________

[1] Demographic transition and the role of financial sector (저출산 고령화와 금융의 역할),) by Sunghoon Yoon, 2011

[2] OECD, Health Status (https://www.oecd.org/en/data/indicators/life-expectancy-at-65.html), 2023

[3] WHO, https://www.who.int/news-room/fact-sheets/detail/dementia